Welcome to Our Company

Empowering Your Clients’ Financial Success

Unlock your clients’ path to financial freedom with NextGen Score Solutions. We understand the importance of a clean credit report in securing a mortgage and achieving financial goals. That’s why we specialize in strategies and Metro 2 compliant language to help your clients overcome poor credit. By partnering with us, you’ll provide your clients with the support they need to rebuild their credit and step into a brighter financial future—ultimately helping you close more deals and grow your business.

About Us

We help clients to get Credit Solutions

At NextGen Score Solutions, we are more than just a credit repair service—we are dedicated partners in helping realtors and their clients achieve financial well-being. Our commitment to overcoming credit challenges and building strong financial foundations has earned us a reputation for excellence and tangible results.

We specialize in supporting realtors by helping their clients improve their credit scores, enabling them to qualify for mortgages and close more deals. As we continue to grow, our mission remains clear: to be a trusted ally for real estate professionals, providing the tools and support needed to rebuild credit and achieve financial goals. We take pride in every success story we contribute to and are honored to be part of your clients’ journey toward financial freedom.

What we do

Our Services

Consumer Law Metro 2 Compliant Letters

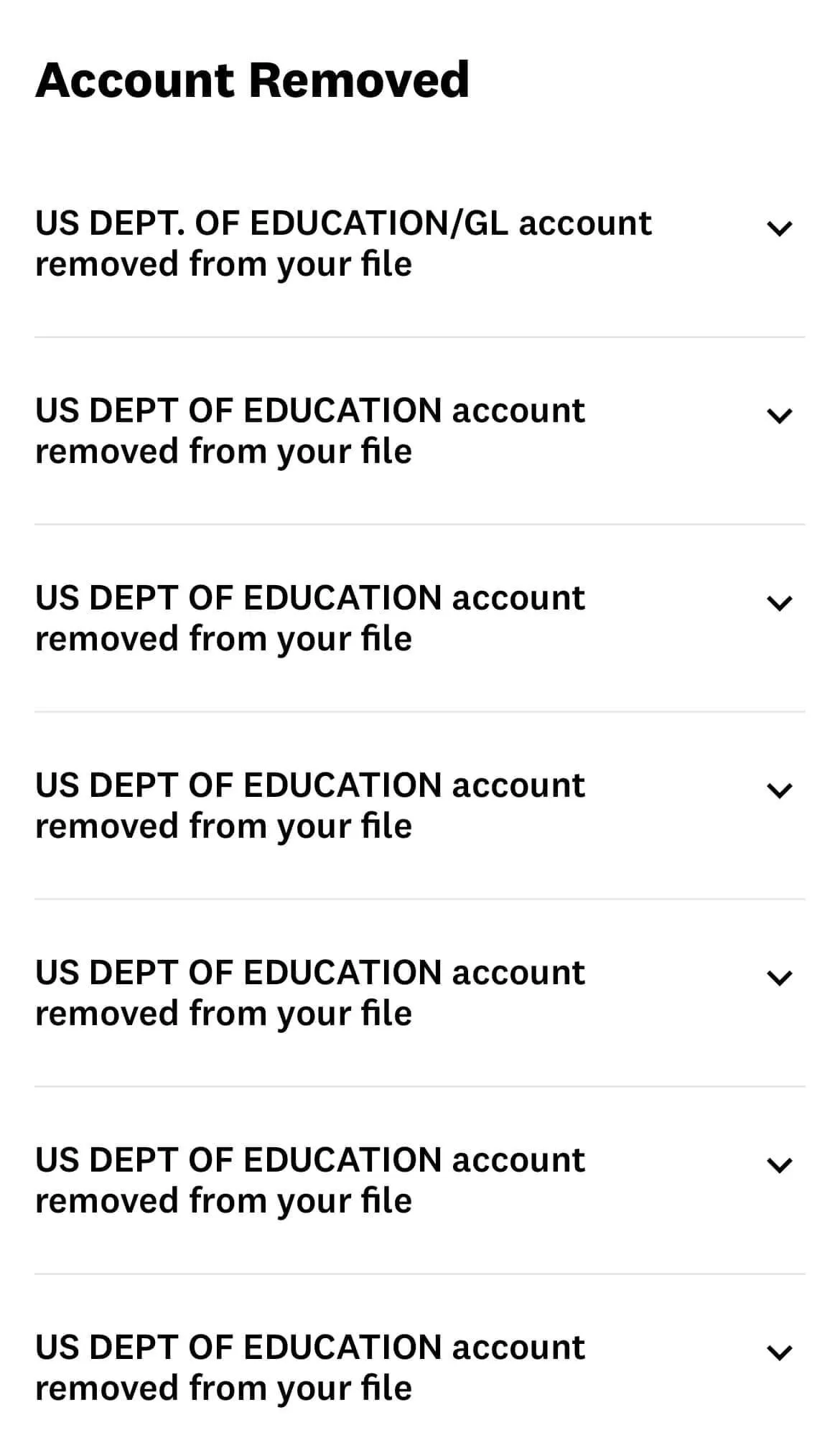

NextGen Score Solutions uses advanced AI to create Metro 2 compliant letters tailored specifically to your credit profile. Our AI-coded letters are meticulously crafted to address your unique credit disputes, ensuring full compliance with consumer law standards while protecting your rights and improving your credit score.

Credit Report Analysis

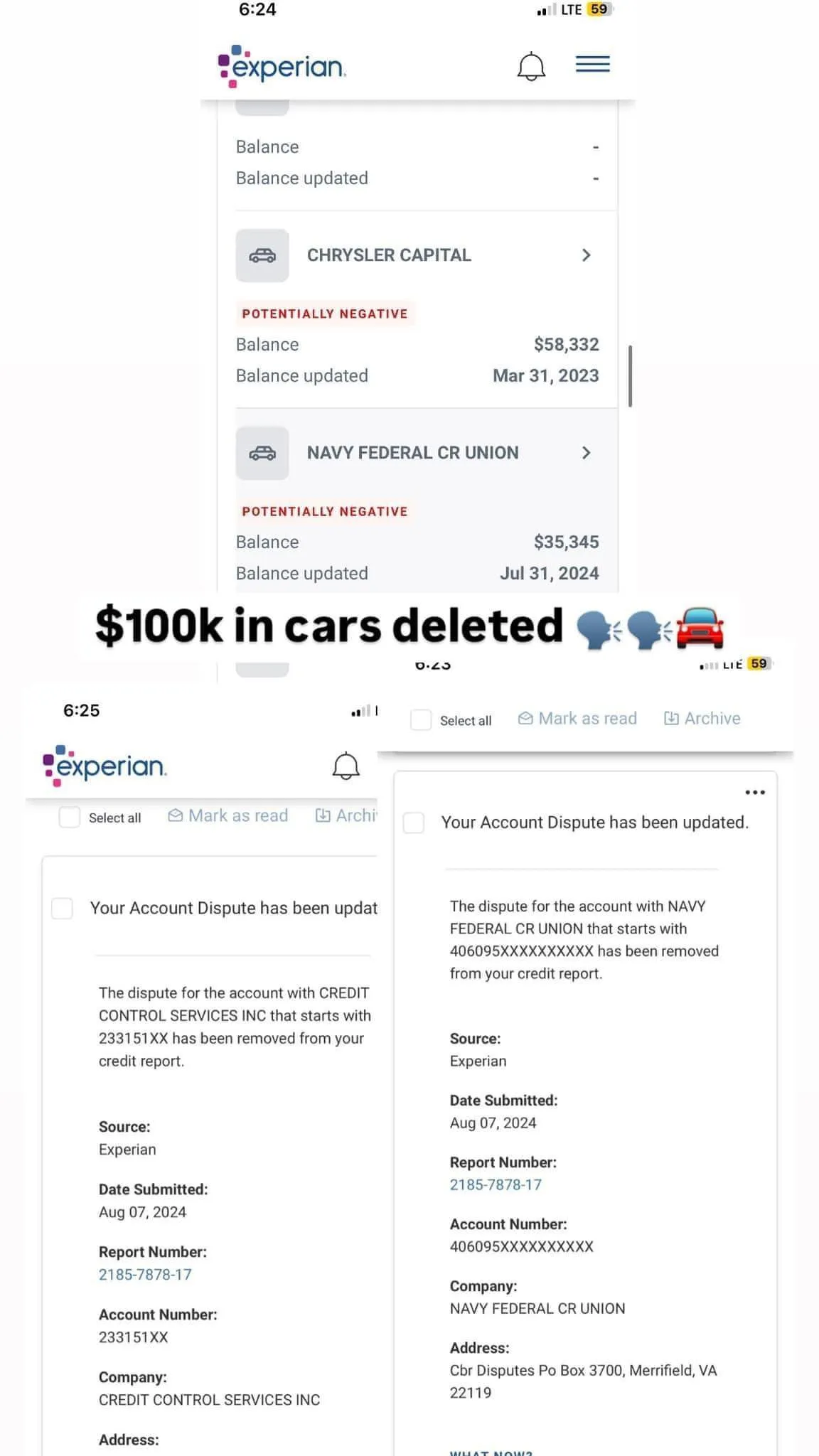

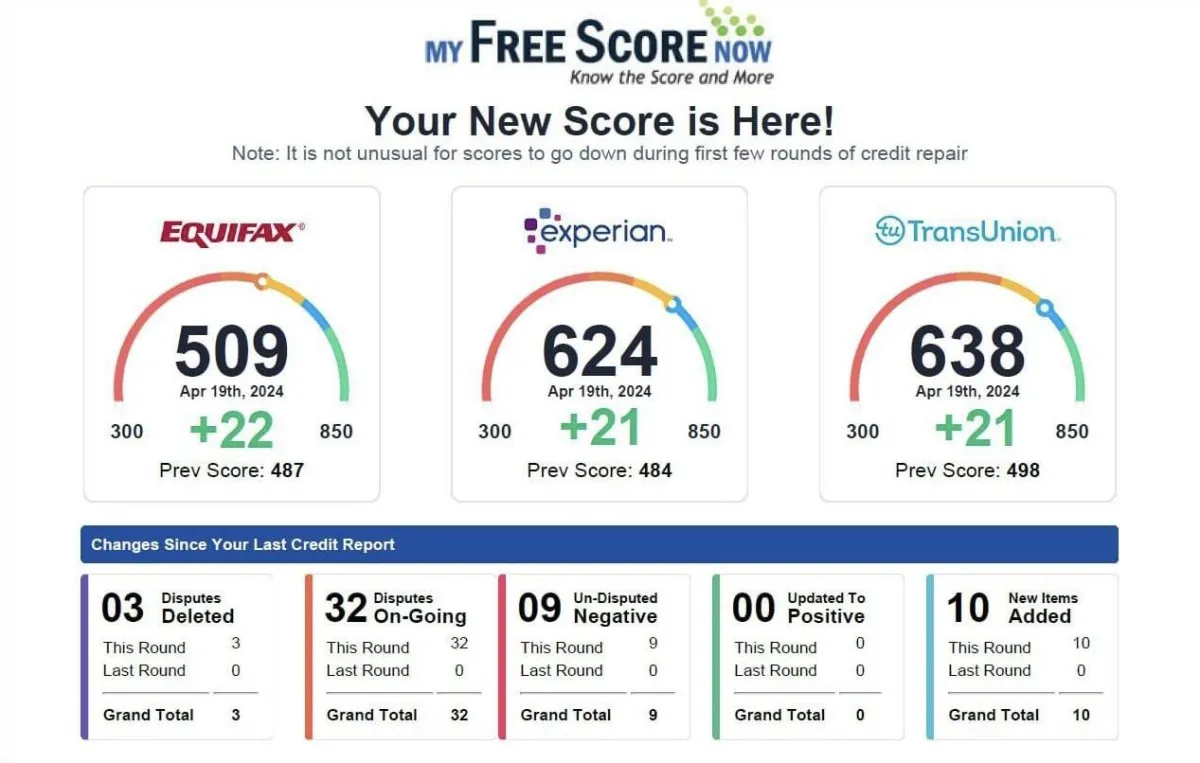

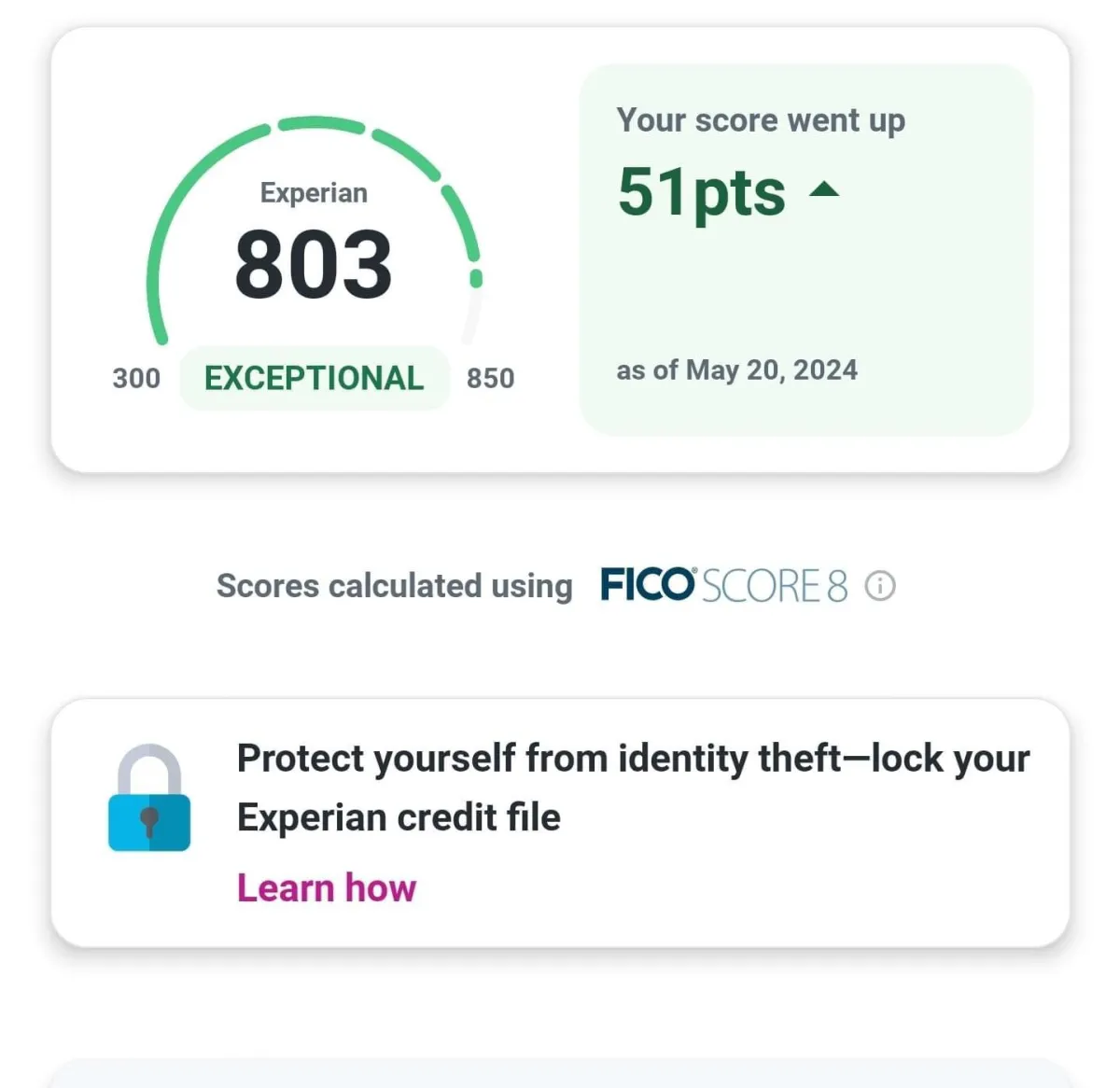

At NextGen Score Solutions, our comprehensive credit report analysis helps you understand every detail of your credit profile. We identify inaccuracies, highlight areas for improvement, and provide actionable insights to help you boost your credit score and achieve your financial goals.

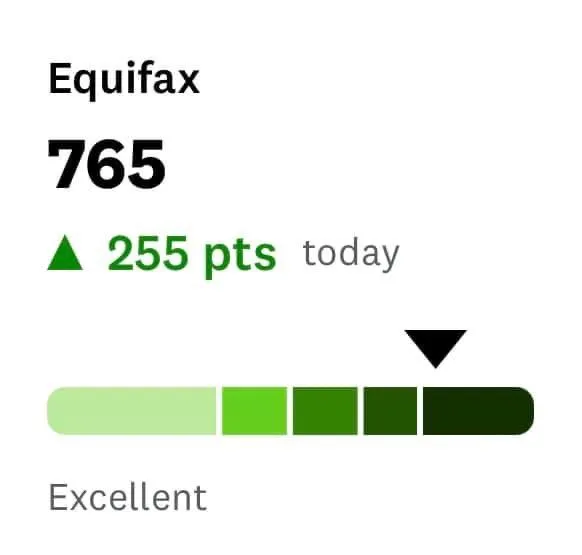

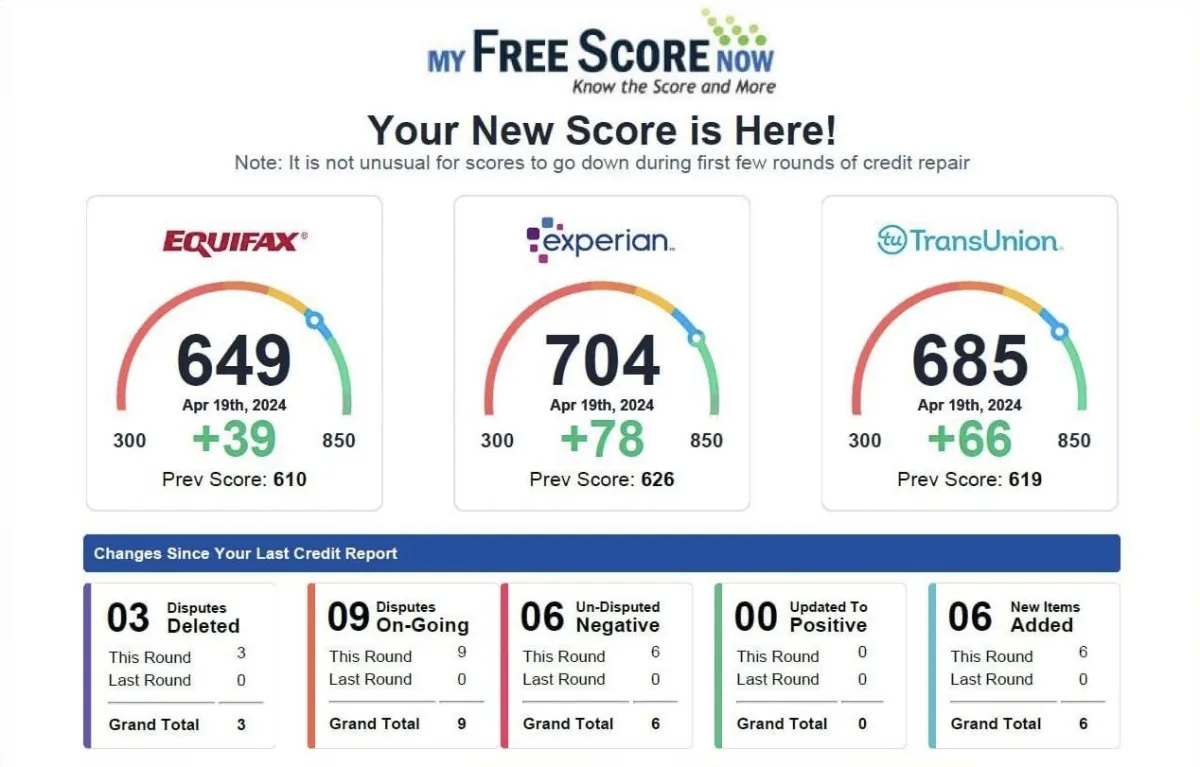

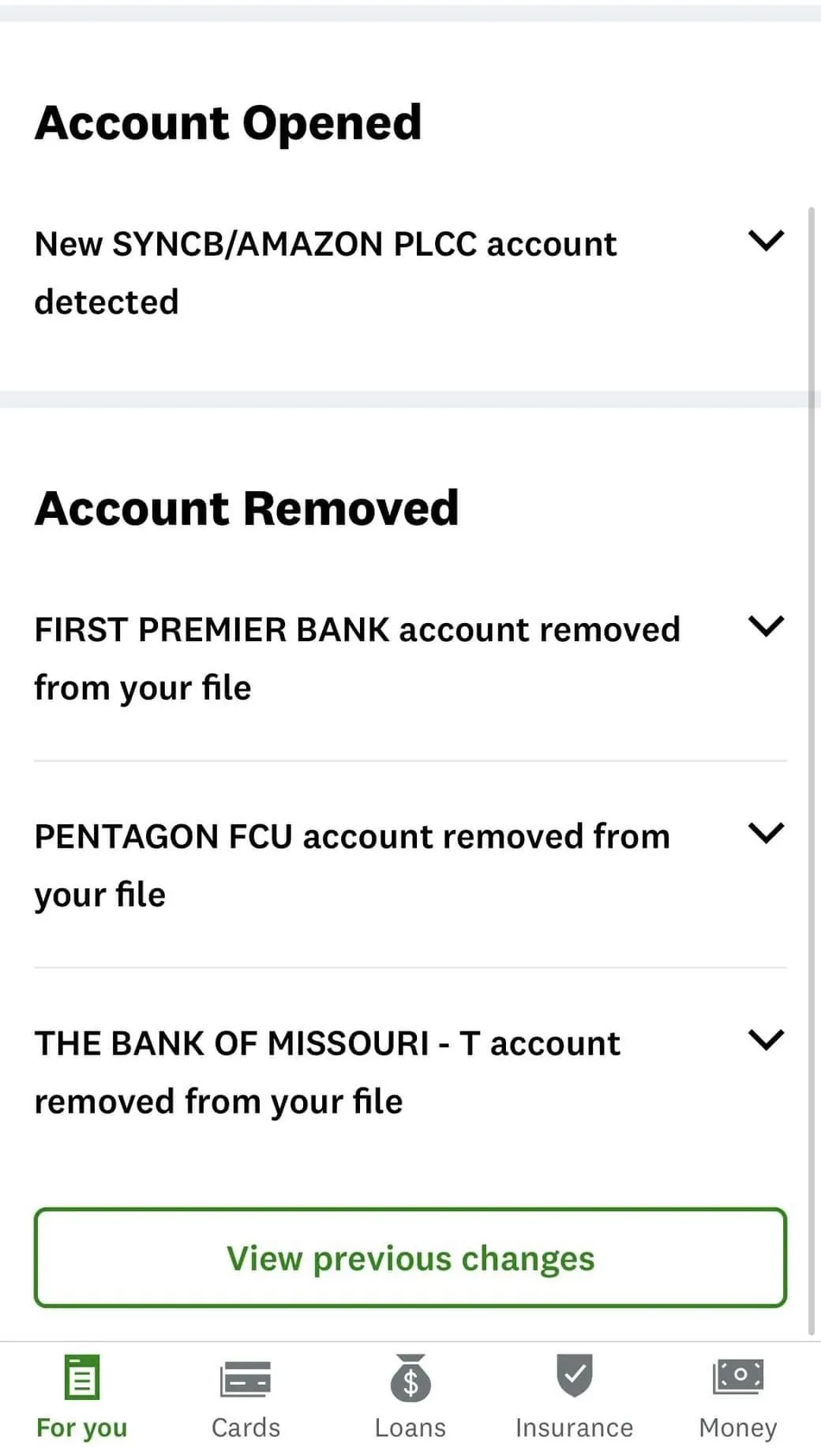

Progress Tracking and Reporting

NextGen Score Solutions offers real-time credit score tracking and detailed reporting to keep you informed of your financial progress. Monitor improvements, spot issues, and see how our services help you rebuild your credit, all through easy-to-understand metrics.

Credit Score Improvement Strategies

NextGen Score Solutions offers tailored strategies designed to improve your credit score efficiently. Our experts analyze your credit report and develop personalized action plans that address your unique financial situation, helping you achieve a stronger credit profile and greater financial stability.

Our Staff

Our Team

Alyssa Whitney

COO

William Campbell

CEO

Mika Zhang

CMO

Testimonials

happy clients

"I can't thank NextGen Score Solutions enough for their outstanding credit repair services. They not only helped boost my clients' credit scores significantly but also provided personalized guidance that made a real difference. Their professional and responsive team genuinely cared about each client's financial well-being, ensuring that they were in a much stronger position to secure their mortgage. Thanks to NextGen, I've been able to help more clients achieve their homeownership dreams, and I’m in a better position financially as well."

Jenny Smith

"My experience with NextGen Score Solutions was overwhelmingly positive. They managed to successfully remove several negative items from my clients' credit reports, which was a huge relief and allowed them to move forward with their home purchases. Although the process took a bit longer than anticipated—understandable given the complexity of some profiles—I truly appreciated the thoroughness and dedication they brought to each case. While more consistent communication would have made the experience smoother, the results speak for themselves. I highly recommend NextGen to anyone looking to improve their credit—the proof is in the pudding!"

Elisabeth Calhoun

"As a realtor, I struggled with my credit score for years, but NextGen Score Solutions changed that. They removed several negative items from my report, boosting my score and helping my clients improve theirs as well. Thanks to their expertise, I’ve closed more deals and helped more families achieve homeownership. I’m back on track financially and couldn’t be happier with the results!"

Jessica Carver

FAQS

What is credit repair?

Credit repair is the process of identifying and disputing inaccuracies, errors, or outdated information on your credit report. At NextGen Score Solutions, we use AI-driven strategies and Metro 2 compliant letters to ensure your credit report is accurate and reflects your true creditworthiness.

How long does the credit repair process take?

The duration of the credit repair process can vary depending on your unique situation, but at NextGen Score Solutions, we prioritize precision in every step. Our AI-driven approach allows us to craft the most accurate and effective disputes tailored to your specific credit profile. By leveraging advanced technology and a deep understanding of consumer laws, we efficiently navigate the complexities of dealing with the credit bureaus. While some results can be seen in as little as 30 days, a comprehensive improvement may take several months. Our focus is on delivering the best possible outcome for your credit, ensuring each step is handled with meticulous care.

Will using a credit repair service negatively impact my credit score?

No, using a credit repair service like NextGen Score Solutions will not negatively impact your credit score. In fact, our goal is to improve your credit by addressing inaccuracies and optimizing your credit report. Our AI-driven methods are designed to ensure that every step we take is compliant with consumer laws and tailored to enhance your credit profile. While we work on resolving any issues, your score may fluctuate as updates are made to your credit report, but the overall impact is geared towards long-term improvement and financial stability.

Can I repair my credit on my own without professional help?

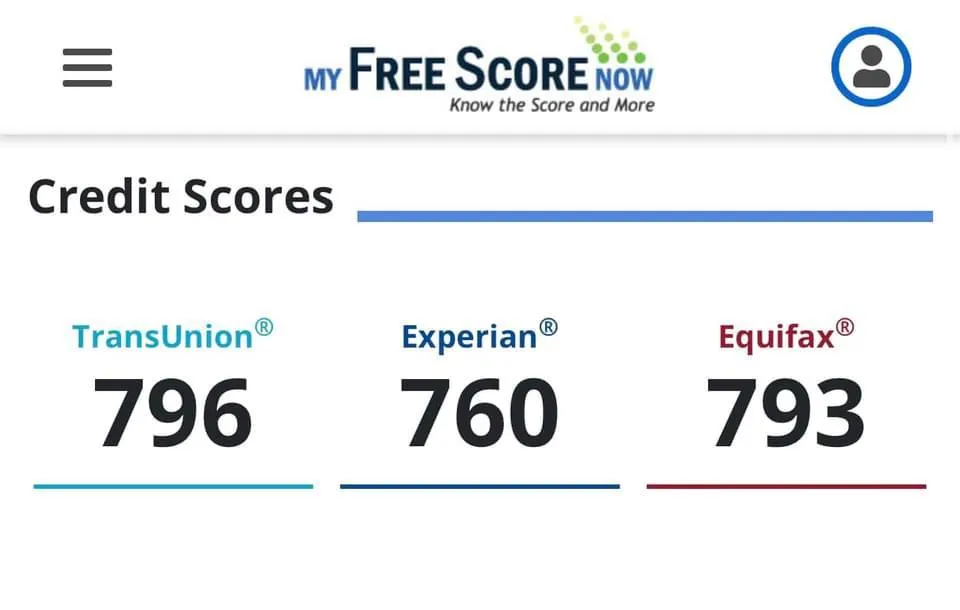

Yes, you have the right to dispute inaccurate information on your credit reports independently. You can request free credit reports from all three major credit bureaus and file disputes directly with them. However, at NextGen Score Solutions, our AI-driven approach, combined with a tailored Epic Pro report from our partners at My Free Score Now, offers unmatched precision and efficiency. We leverage consumer laws and advanced technology to navigate the complexities of credit reporting systems on your behalf. This not only streamlines the process but also ensures your rights are fully protected, potentially yielding better results. By choosing our services, you save valuable time and effort while ensuring your credit repair journey is handled with the utmost accuracy and compliance.

How does the credit repair process work?

Our process begins with a detailed analysis of your credit report using a tailored Epic Pro report from our partners at My Free Score Now. We then identify any inaccuracies or errors and dispute them with Metro 2 compliant letters to credit bureaus on your behalf. Throughout the process, we keep you informed with regular updates on your progress.

What is Metro 2 compliant letters?

Metro 2 compliant letters are specifically designed to meet the credit reporting industry standards set by the credit bureaus. These letters are crafted using AI technology and tailored to your credit profile, ensuring that your disputes are handled with the highest level of accuracy and compliance.

Is my information safe with NextGen Score Solutions?

Absolutely. We take your privacy and security very seriously. All of your personal information is handled with the highest level of confidentiality and security, ensuring your data is protected at all times.

Get In Touch